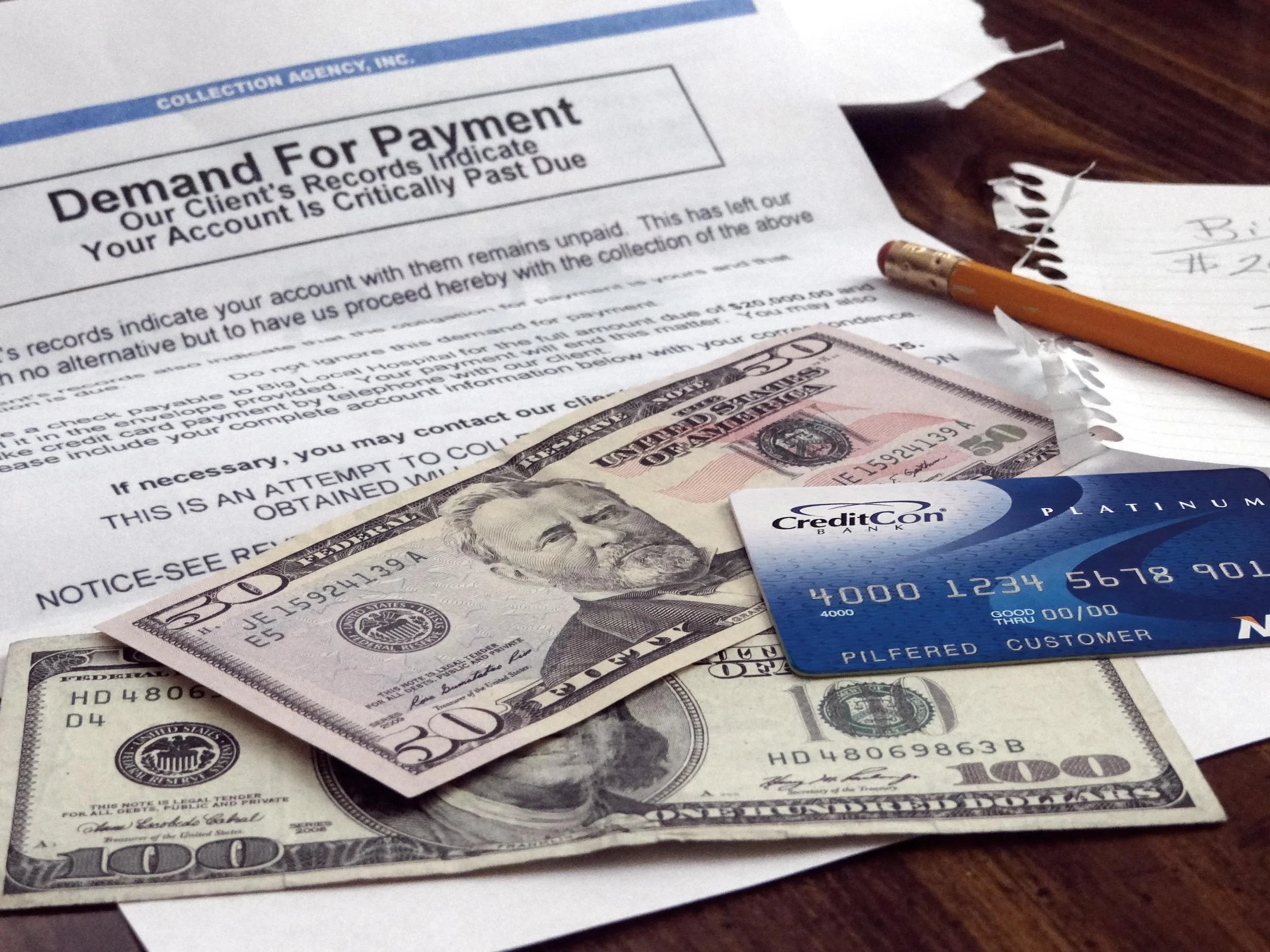

In my previous article, Will Paying Collections Help My Credit Scores?, I discussed the common misconception that paying a collection account will raise your credit scores. It is true that paying a collection account probably will not raise your credit scores and, in some cases, may even lower your scores if recent activity is reported on the account due to your payment. However, there is another credit myth which I would like to debunk today and that is the misconception that a collection account cannot be legally removed from your credit report. The statement that a collection account cannot legally be removed from your credit report is simply untrue. When a collection account is deleted from your credit report the result is almost always a credit score increase - great news for the consumer! There are several possible ways that collection accounts can be deleted from your credit report. Let's discuss a few of them:

Removal by Dispute -

Have you checked your credit report lately? Chances are that, if you did so, you found errors and inaccuracies. In fact, a recent study released by the Federal Trade Commission found that 40 million Americans had errors on their credit reports.

According to the Fair Credit Reporting Act (FCRA) you have the right to dispute any errors, mistakes, or inaccuracies with the credit reporting agencies - Equifax, Trans Union, and Experian. If any of the data is incorrect on an account (i.e. the balance, the date of first delinquency, the date of last activity, the date opened, the date of default, the date reported, account notations, etc.) then you have the right to dispute it. Furthermore, you are even allowed to dispute erroneous accounts with creditors and collection agencies directly.

Pay for Deletion -

It is possible for you to make an arrangement with a creditor or collection agency to pay an account in exchange for the deletion of the account from your credit report. You should know that it is extremely difficult to get a creditor or collection agency to agree to these terms. Some companies will reject a pay for deletion offer out right. However, payment for deletion is possible and it is 100% legal.

There is nothing in the Fair Credit Reporting Act which compels a creditor or collection agency to report an account to the credit bureaus. The reporting of accounts is 100% voluntary. Even though it is not illegal for an account to be paid for deletion, the act is frowned upon by the credit bureaus and most of the agreements that the bureaus have with collection agencies states that the collection agencies cannot engage in pay for deletion settlements.

Finally, if you do get a creditor or collection agency to agree to a pay for deletion arrangement you will likely be required to pay 100% of the debt. As with any debt negotiation, it is always important to get agreements sent to you in writing since "he said, she said" will not hold up if a dispute arises later.

Goodwill Deletion -

You can request for a creditor or collection agency to grant you a goodwill deletion after an account has been paid. It is a long shot to have a goodwill deletion request honored; however, it certainly cannot hurt you to ask.

These are a few of the ways that a collection account can be removed from your credit reports. You have the right to try to employ some of these strategies on your own, though doing so will likely be time consuming and very difficult. You also have the right to hire a reputable credit restoration company to assist you. If you would like to speak with a HOPE Credit Expert regarding your credit report please give us a call at 704-499-9696 or click here to schedule a no-obligation credit analysis today.

Michelle Black is an author and a credit expert with over a decade of experience, the credit blogger at HOPE4USA.com, a recognized credit expert on talk shows and podcasts nationwide, a contributor to the Wealth Section of Fort Mill Magazine, and a regularly featured speaker at seminars up and down the East Coast. She is an expert on improving credit scores, credit reporting, correcting credit errors, budgeting, and recovering from identity theft. You can connect with Michelle on the HOPE Facebook page by clicking here.