No matter the size of your holiday budget, finding ways to stretch your hard earned money is a smart idea. There is no shame in looking for ways to get the most bang for your Christmas buck. Here are 7 simple ways to help stretch your holiday budget to the max.

1. Sales

Whether you are buying a turkey or a video game, stores are in the habit of offering big discounts during the holiday season in an effort to pull consumers into their stores. Without a doubt the most effective way to save money during the holidays is to shop smarter. Before you set out to buy anything take the time to do a quick internet search and see which stores are offering the best prices on the items you plan to purchase. Apps like ShopSavvy and Walmart Savings Catcher can make this process much easier as well. Don't forget that you can often save money shopping with reputable online retailers as well, especially when combining discounted online prices with free shipping offers.

2. Coupons

Another great way to save money during the holidays (or any time of the year for that matter) is to use coupons. Websites like www.retailmenot.com make it a breeze to check for available coupons for thousands of retail locations. Remember that many brick and mortar stores will honor the coupons of their competitors as well so it is often possible to combine the best sales prices available with a competitor's coupon for even bigger savings.

3. Price Matching

Many large retailers (i.e. Target, Walmart, Best Buy, etc.) will match the prices of sales from other stores. If you want to save a ton of money without driving all over town just take current sales papers from other stores with you. Some stores will even price match with online retailers such as Amazon.com. Wal-mart, for example, will match the sales prices of other retailers on everything from holiday foods to toys and video games.

4. DIY

Perhaps my favorite money saving idea for the holidays comes in the form of do-it-yourself gifts. DIY gift ideas can range anywhere from homemade holiday goodies to scrapbooks to hand painted ornaments with your children. If you are running short on crafty ideas websites like Pinterest.com can be a huge help. Plus, as a bonus, handmade gifts are often the most treasured and most remembered gifts received amongst a sea of store bought products.

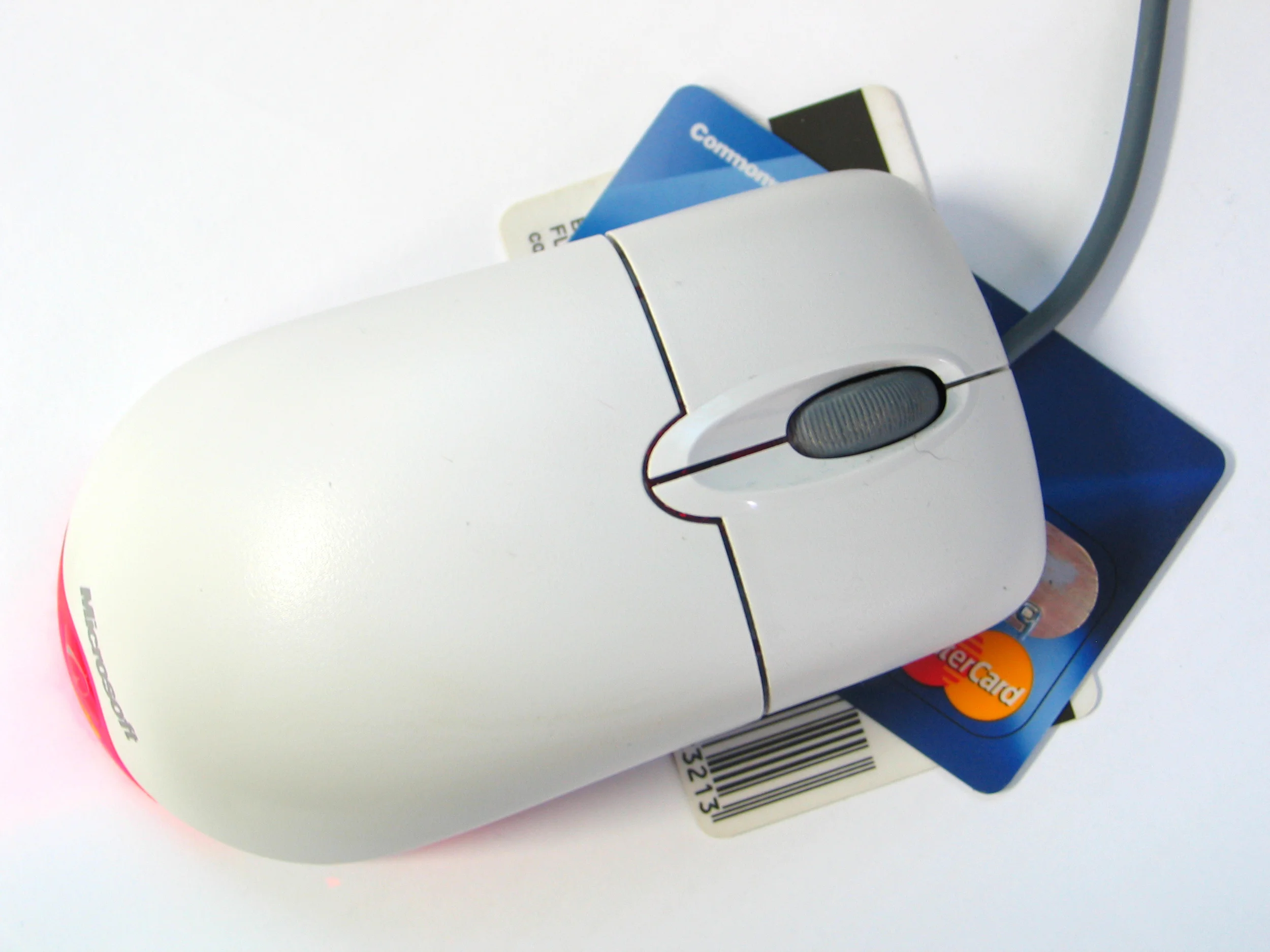

5. Rewards

Christmas is a great time to cash in the rewards and bonuses you have been banking on your favorite rewards credit card. Rewards can often be redeemed for a variety of products and/or gift cards - all of which can make great presents for the loved ones on your Christmas list.

6. Give the Gift of Time

The idea that only "stuff" makes good Christmas gifts is completely false. Another great gift idea can be to do something for your loved one instead of giving them an item. For example, you could make a coupon (or even just a thoughtful Christmas card) which your loved one can cash in for a free month of house cleaning, baby sitting, tax preparation, car washing, a home cooked meal, etc. The possibilities are virtually endless.

7. Volunteer

It can be easy to get sucked into the social pressure to buy the biggest and best gifts for your family. Many consumers take out loans or rack up a small mountain of credit card debt in order to make these expensive purchases, often unknowingly compromising their financial health and credit scores in the process. There is no better way to remind yourself and your family of the true meaning of Christmas than through volunteering to help those less fortunate than yourselves. Whether you put together a gift for a child in a third world country (www.ambassadorstothenations.com) or volunteer at your local soup kitchen there is nothing like giving your valuable time to others to help put your priorities back in order.

Set yourself up for a much more enjoyable holiday season this year by following some of the tips above. Be sure to check back next week for tips from our HOPE4USA credit experts on how you can build the perfect holiday budget and you will be a holiday pro before you know it.

Michelle Black is an author and a credit expert with over a decade of experience, the credit blogger at HOPE4USA.com, a recognized credit expert on talk shows and podcasts nationwide, a contributor to the Wealth Section of Fort Mill Magazine, and a regularly featured speaker at seminars up and down the East Coast. She is an expert on improving credit scores, credit reporting, correcting credit errors, budgeting, and recovering from identity theft. You can connect with Michelle on the HOPE4USA Facebook page by clicking here.