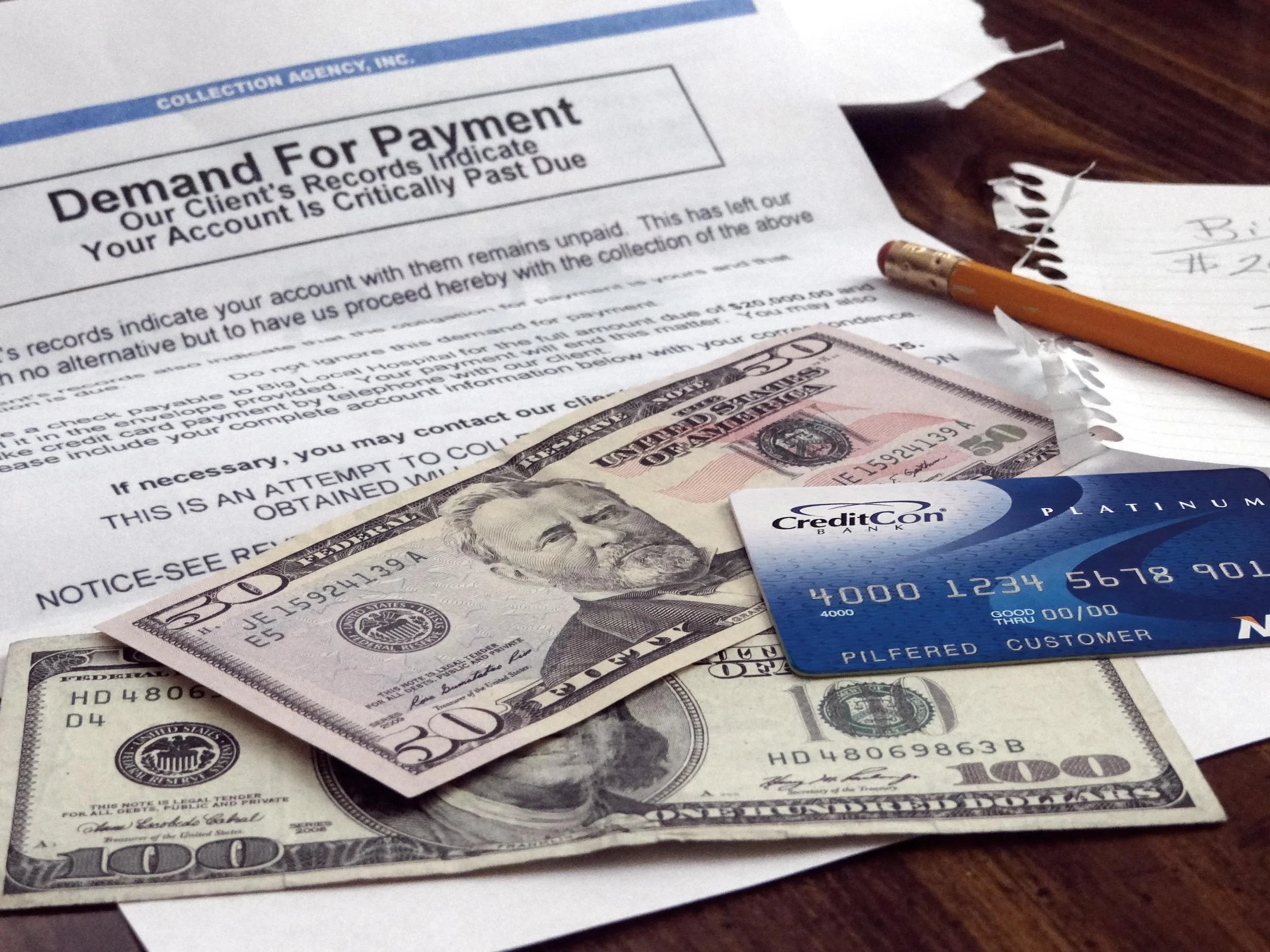

Does the arrival of your monthly credit card bill strike fear into your heart? Have you ever discovered that your checking account is empty without knowing where your paycheck could have possible gone so quickly? Do you have more new pairs of shoes in your closet than you can count? If you answered yes to any of these questions then you may have a problem with overspending.

Overspending is one of the most common causes of poor credit scores and unbalanced budgets. Of course, typically consumers do not set out to overspend; however, without a solid plan for spending it is easy to find yourself in the uncomfortable situation of having more bills than money over and over again. When you find yourself short on cash that is when bills get paid late (or not at all) and credit scores begin to slip.

Keep in mind, over-spenders are not bad people! Our team of credit experts at HOPE4USA has helped many, many people to overcome credit problems, a sizable percentage of whom arrived at those credit problems due to overspending. The good news is that if these clients were able to fix their overspending problems and turn their credit reports back around then it is possible for you to do the same. Here are a few tips to get you started on kicking the habit of overspending:

1.) Write down every dollar you spend for the next 2 weeks.

Analyzing your spending habits is the first step to help you find out if you have an overspending problem and, if so, how severe the problem has become. Wives and girlfriends, if you are asking your spouse or boyfriend to track their spending you may want to note that men are typically a little more resistant to doing so. My suggestion? Make it easy for them! Give him a simple 3X5 card to keep in his wallet. Just ask him to jot down the amount spent and where he spent it if he does not want to save receipts. You will still get the basic information you need this way and he may be more likely to follow through with your request.

2.) Make a spending plan (in writing) and stick to it.

You may be wondering, “What exactly is a spending plan?” A spending plan is a written list of your monthly income (paycheck, alimony, child support, etc.) and your monthly expenses (rent, utilities, car payment, etc.). In other words – it is a budget. You can even CLICK HERE to download a free copy of the HOPE4USA Basic Budgeting Worksheet - no strings attached. The key is to get started. (Note: if you are a current HOPE4USA client you can ask your case manager to review your completed budgeting worksheet offer advice and suggestions. Talk about a great membership perk!)

3.) Trim the fat from your spending plan.

Once you have reviewed your 2 week spending list and completed your budget worksheet, look for areas where spending can be cut. Now, I’m not talking about sucking all the fun out of your life so be sure to resist the urge to respond negatively to this suggestion. However, I am suggesting that you make a plan to get the things that you really want out of life (i.e. a new home, a new car, college education for children, family vacations, etc.) by figuring out what you can live without in the present. You may be able to find hundreds of extra dollars per month by reducing cable TV plans, cell phone plans, entertainment expenses, eating out expenses, or shopping. Don’t be afraid to take an honest look at your spending habits and see if a change can and should be made.

Michelle Black is an author and a credit expert with over a decade of experience, the credit blogger at HOPE4USA.com, a recognized credit expert on talk shows and podcasts nationwide, a contributor to the Wealth Section of Fort Mill Magazine, and a regularly featured speaker at seminars up and down the East Coast. She is an expert on improving credit scores, credit reporting, correcting credit errors, budgeting, and recovering from identity theft. You can connect with Michelle on the HOPE4USA Facebook page by clicking here.