Unsecured Subprime Credit Cards

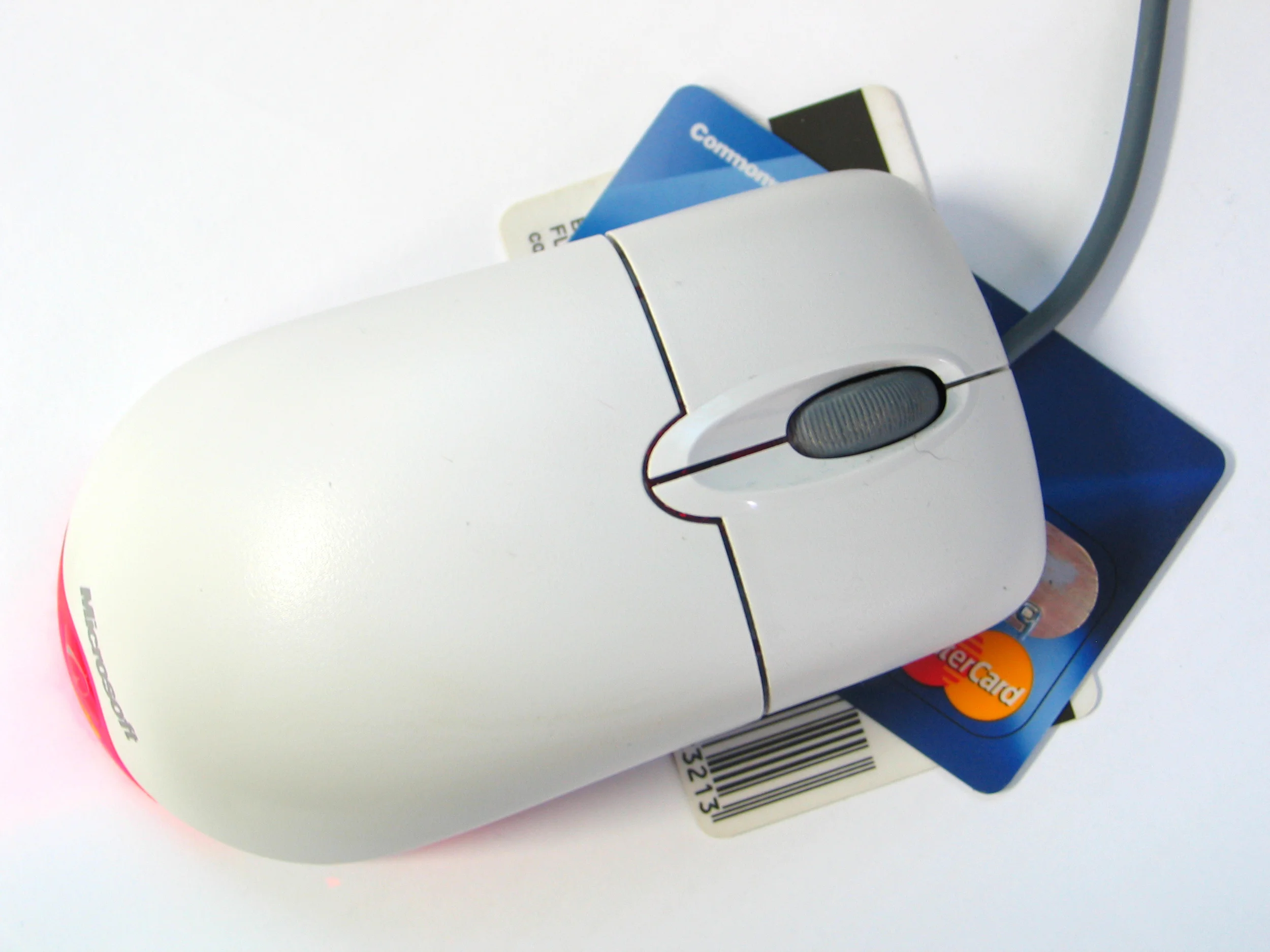

Another plastic option which is available to consumers with no credit or damaged credit is the unsecured subprime credit card. Unsecured credit cards are the most common type of credit cards. They must be applied for, an approval must be granted, and (if a consumer is approved) a credit limit is assigned to the account. Unlike prepaid debit cards, unsecured subprime credit cards do offer credit building opportunities since they typically report to all 3 of the major credit bureaus each month - Equifax, Trans Union, and Experian. Plus, if a consumer is approved for one of these accounts, she does not have to put down a large deposit in order to secure her new line of credit.

Unfortunately, the primary draw back when it comes to these types of credit cards is the fact that they are usually loaded with high interest rates and incredibly high fees. It is not uncommon for an applicant to be approved for an unsecured subprime credit card only to receive a card which is practically maxed out as soon as it is issued due to all of the initial fees associated with opening the account. CLICK HERE to read more about how high balances on credit card accounts are bad for credit scores.

Secured Credit Cards

The best option for consumers with bad credit or no credit is, without question, the secured credit card. Secured credit cards, like unsecured subprime credit cards, offer great credit building opportunities when managed properly. However, secured cards typically offer this credit building opportunity without the often astronomically high fees associated with unsecured subprime credit cards. They are actual credit cards, unlike prepaid debit cards, which usually report to all 3 credit bureaus.

When a consumer is approved for a secured credit card she is required to make a deposit with the issuing bank which will be equal to the credit limit on the card. For example, if a consumer makes a $300 deposit then she would receive a secured credit card with a limit of $300. The deposit, however, is not the same as loading funds onto a prepaid debit card. If the consumer charges $25 on her secured credit card then she is responsible to pay the funds to the bank as they are not merely deducted from her initial deposit. Secured credit cards also typically offer very easy qualification standards so it is relatively easy to qualify for a secured card even for consumers with no credit or damaged credit.

How to Choose

Regardless of which type of plastic you choose it is important to do your research first. Comparison sites like GreatCredit101.com allow consumers to view the rates and fees associated with multiple cards before they ever apply for an account.