Whether or not you are a believer in New Year's resolutions it is a smart idea to take an honest look at your credit from time to time in order to see how it can be improved. Good credit can help you to save tons of money, get approved for the loans you need, and can even help you to land a better job. It is 100% worth your time, energy, effort, and money to work towards achieving and maintaining the best credit possible.

Here are 7 steps that every single person can take to make steps toward having better credit this year.

1. Pay every bill on time.

The importance of paying your credit obligations on time, every time cannot be overstated. In FICO's credit scoring model a whopping 35% of a consumer's credit scores are assigned based upon factors included in the "Payment History" category of a consumer's credit reports. If late payments do occur you can bet the bank that they will have a very negative credit score impact.

2. Cut spending.

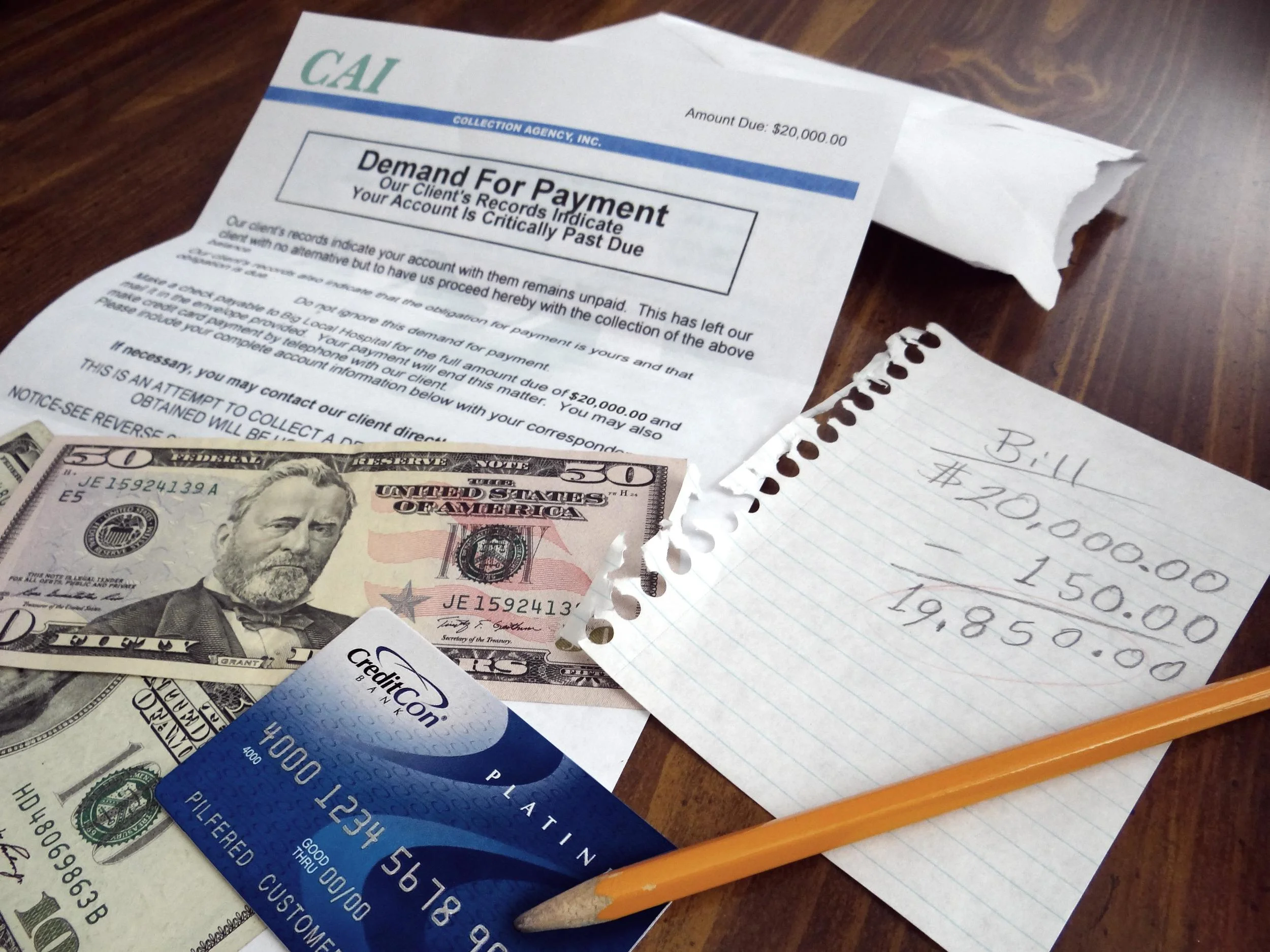

Overspending is perhaps the #1 cause of credit problems for most Americans. When consumers charge more than they can afford to pay off in any given month not only do they hurt their credit scores by doing so (yes, credit card debt can in fact lower credit scores even when payments are made on time), but they also set themselves up for financial problems and serious credit problems in the future. In fact, overspending can lead to late payments, collections, judgments, and even bankruptcy if the problem is left unchecked.

3. Make a plan.

Failure to plan is the same as planning to fail. A well planned budget is a crucial step towards healthier credit. Smart consumers tell their money where to go instead of wondering where the money went after it has already been spent. CLICK HERE for a free copy of the HOPE4USA Basic Budgeting Worksheet to get started.

4. Establish credit.

Credit cards can be extremely useful tools in building or rebuilding better credit, as long as they are managed properly (on-time payments and never revolving a balance from month to month). Even consumers with credit issues can qualify for many secured credit cards. CLICK HERE for a list of credit cards to compare and see which ones might be a good fit for you.

5. Become familiar with your credit reports and scores.

Every consumer should be in the habit of checking all 3 of his credit reports often. The credit bureaus and your creditors are obligated by law to report accurate information on consumer credit reports. However, it is up to you and you alone to ensure that the information contained on your credit reports is actually correct.

You can access your 3 free credit reports each year at www.annualcreditreport.com (credit reports only, not scores). You can also access your credit scores for a fee or as part of a free trial offer from a credit monitoring service. CLICK HERE to compare credit monitoring services which may offer free or low cost credit scores as part of their introductory offer.

6. Correct errors.

Errors occur on credit reports all the time. In fact, in 2013 the Federal Trade Commission released a study which found over 40 million errors to be present on consumer credit reports. If you discover incorrect or suspicious information on your credit reports then you have the right to dispute that information according to the Fair Credit Reporting Act.

Disputes can be handled yourself or you also have the right to hire a professional credit expert like our HOPE4USA team to assist you. CLICK HERE to schedule a no-obligation credit analysis with a HOPE4USA credit expert to learn more about how our team can help you fight for the better credit you deserve. Fixing credit problems can certainly be a difficult job, but it is not a job that you have to do alone.

7. Establish goals.

The final tip is perhaps the first step that you should take as you set out on your journey toward better credit. Identify the reason why you want to achieve better credit. Do you desire to purchase a home for your family? Is your goal to have the strong credit you need to finance your education or the education of your children? Do you need better credit to start or build a business? Building better credit can be a long, hard journey (especially if you are working alone without professional help). Your "why" can help you to stay the course even if you feel frustrated or impatient at certain points within your journey. Your "why" is also the reason that all of your hard work will be worth it in the end.

Michelle Black is an author and a credit expert with over a decade of experience, the credit blogger at HOPE4USA.com, a recognized credit expert on talk shows and podcasts nationwide, and a regularly featured speaker at seminars up and down the East Coast. She is an expert on improving credit scores, credit reporting, correcting credit errors, budgeting, and recovering from identity theft. You can connect with Michelle on the HOPE4USA Facebook page by clicking here.