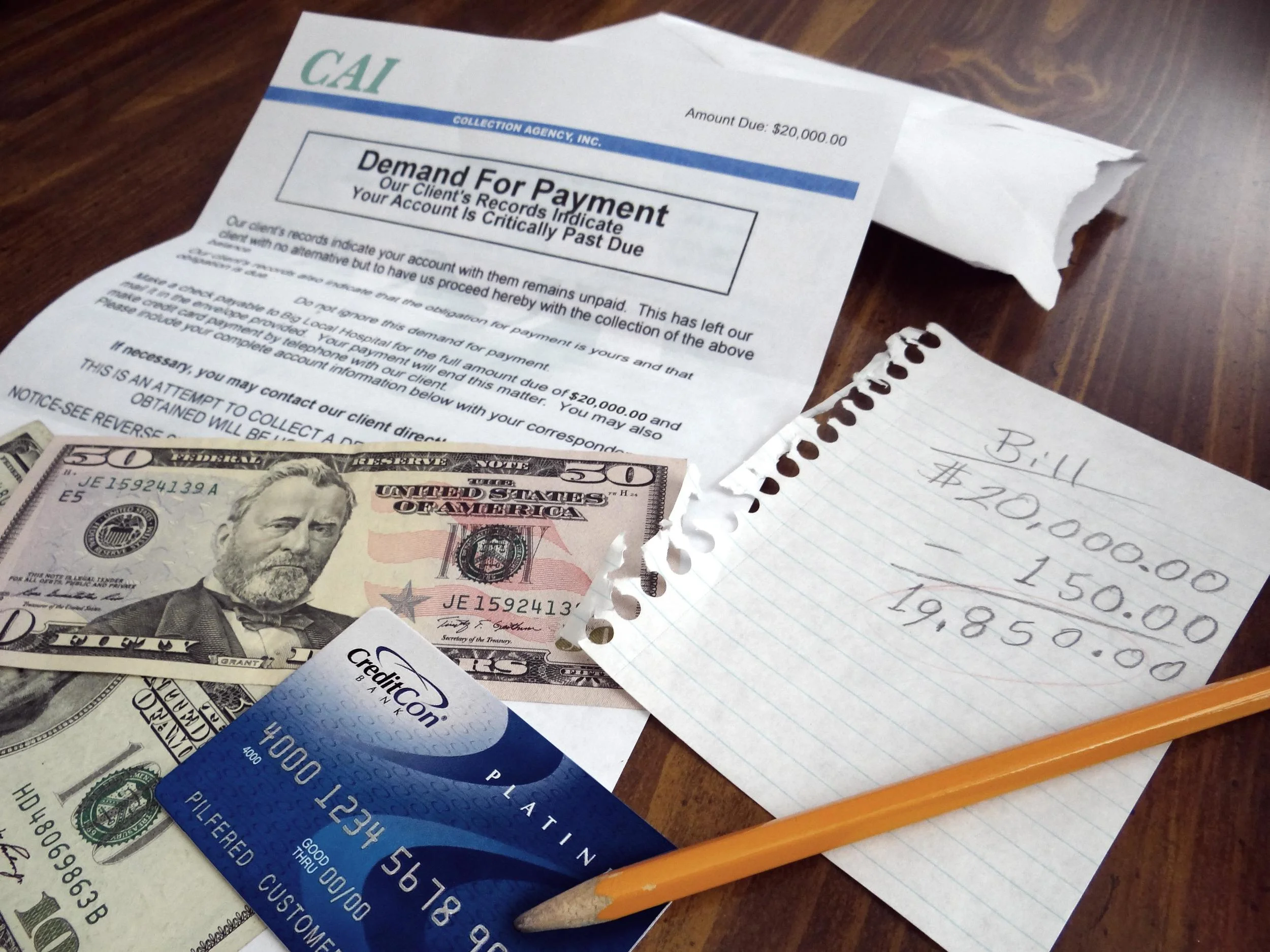

There are many holiday traditions which are beautiful, meaningful, and worth repeating year after year. However, the tradition of holiday overspending has become all too common among American consumers. Trust me, I understand the temptation to overspend during the holidays and I have heard every excuse in the book given to try to justify this bad habit. "I want to do something really special for my loved one this year because he/she has been going through a difficult time. I'm not worried about charging gifts on my credit cards because I will pay the balances off in a few months with my tax refund. Money is so tight during the rest of year so my family and I deserve to have a little fun during the holidays."

It is much easier for consumers to talk themselves into overspending during the holidays than at any other time of the year. Social pressure, pressure to please loved ones (whether the pressure is real or perceived), and incessant retail marketing can make it difficult for many consumers to stick with a spending budget they can actually afford. However, the truth is that consumers do not have to fall into the debt trap in order to have a happy and meaningful holiday season with their loved ones.

The Plan

The single most effective way for a consumer to swear off holiday overspending once and for all - and to actually achieve this goal - is to start with a plan. As a reader of the HOPE4USA Credit Blog you know that having a written budget to follow for your monthly expenses is essential to financial and credit success. (Need help creating a monthly budget? CLICK HERE for a free HOPE4USA Budgeting Guide.) However, with all of the extra expenses present during the holiday season it is also important to have a separate, written budget for holiday spending as well.

How It Works

When starting a holiday budget it is important to begin by listing the amount of money which is actually available for spending, not the expenses. Starting with the amount of money you can actually afford to spend (without going into debt or dipping into non-holiday savings) will help you to build the most effective budget possible.

Let's say that you determine your total available spending limit for the holidays should be $1,000 or less. The next step should be to divide those funds into spending categories such as charitable giving, Christmas presents, holiday treats and meals, decorations, and unplanned expenses. The funds can be allocated within the spending categories however you see fit. Here is a possible example:

· Charitable Giving - $100 (10% of available funds)

· Christmas Presents - $550 (55% of available funds)

· Holiday Treats and Meals - $200 (20% of available funds)

· Decorations - $50 (5% of available funds)

· Unplanned Expenses - $100 (10% of available funds)

Once you have separated your available funds into separate spending categories you can move on to determining how much you will spend for each person on your Christmas gift list. One of my favorite strategies for budgeting Christmas gifts is to list each person for whom you wish to buy a gift in their order of importance. Next you can determine which percentage of funds you wish to spend on each person and calculate those percentages against your pre-set budget to find out your gift "allowance" for everyone on the list. Here is an example.

· Spouse - 20% ($110 in the example budget above)

· Child #1 - 15% ($82.50 in the example budget above)

· Child #2 - 15% ($82.50 in the example budget above)

· Grandchild #1 - 10% ($55 in the example budget above)

· Grandchild #2 - 10% ($55 in the example budget above)

· 4 Friends - 5% each ($27.50 each in the example budget above)

· Misc. Friends, Teachers, Neighbors, etc. - 1% each ($5.50 each in the example budget above)

Make the commitment to set a budget and stick to it and you will make the holiday immensely more enjoyable for yourself and your family this year. As a bonus you can give yourself and your family the gift of starting 2015 off on the right foot financially, without a Christmas overspending hangover.

Merry Christmas from HOPE4USA! Click the image to the left to download the HOPE4USA Basic Christmas Budget worksheet and set yourself up for a holiday season without regrets.