The title of this piece alone is enough to ruffle the feathers of the die-hard believers in the cash-and-carry lifestyle. So, before I even begin with my explanation of the many ways that swearing off credit can come back to bite you, let me begin by stating that you can still live a debt free lifestyle while building a solid credit score. Don't believe me? Has your favorite financial guru told you otherwise? Before you shake your head and move on to the next item in your newsfeed, take 5 minutes to hear me out. Trust me, you will be glad that you kept reading.

Your Credit Score Is NOT Your Debt Score

Despite what you may have heard, credit scoring models do not reward consumers for going into debt. In fact, the truth is quite to the contrary. The idea that you have to carry a lot of debt in order to have good credit scores is completely false. It is 100% possible for you to be debt free and still have very good credit scores.

Credit scoring models like FICO pay a lot of attention to a consumer's debt load. Many consumers find it surprising that a whopping 30% of their FICO credit scores come from what is known as the "Debt Category" of their credit reports. Credit scoring models are constructed so that the more you owe, the worse it is for your scores. This fact is especially true when it comes to credit card debt. However, if you have credit cards with zero balances you will be heavily rewarded in the credit score department. Having credit card accounts which you keep paid off shows the credit scoring models that you are a good credit risk. Conversely, charge up more credit card debt than you can afford to pay off in a month and not only will you waste money on interest fees but your credit scores will also suffer.

Credit Matters In More Ways Than You Think

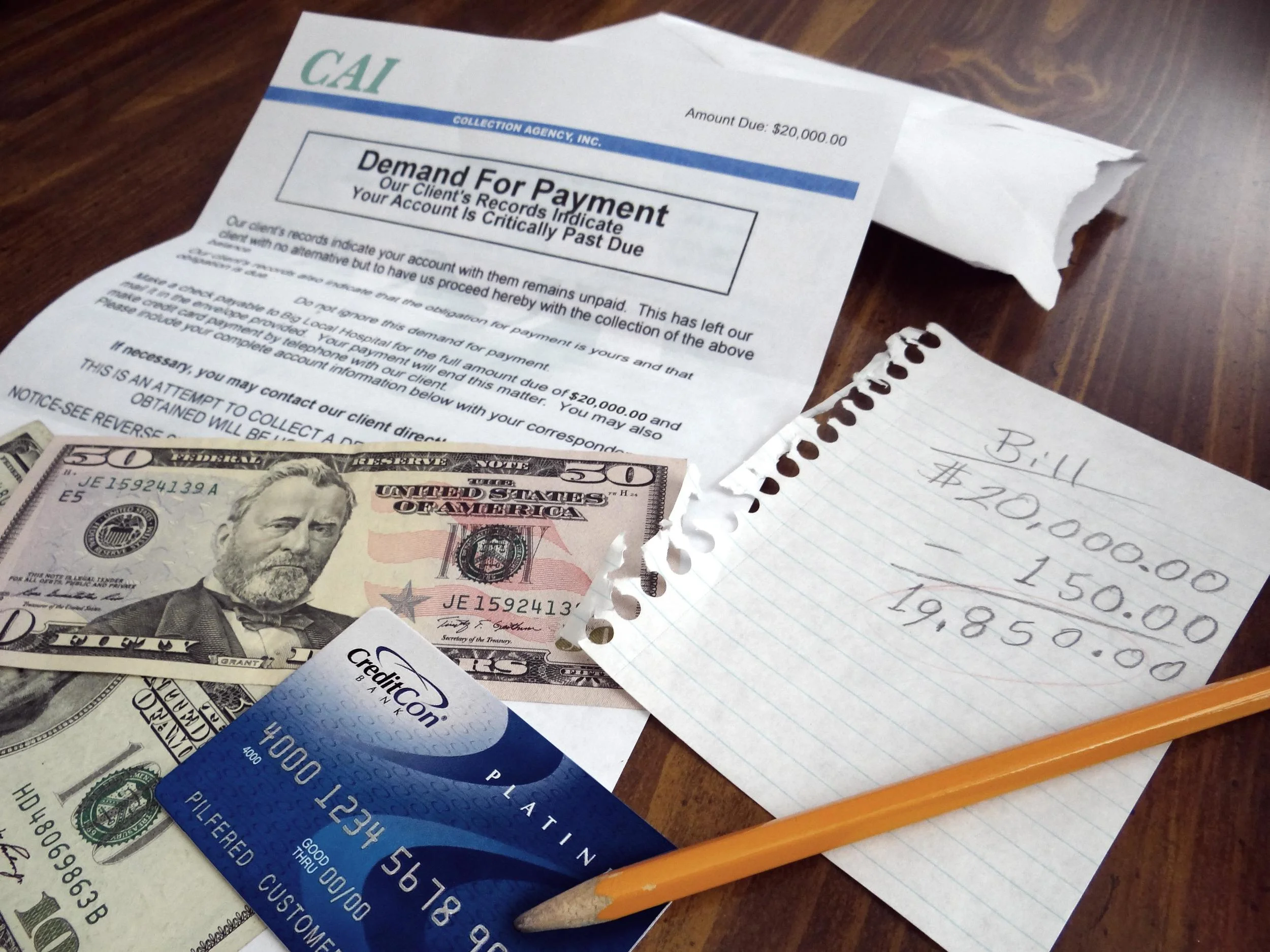

If you have experienced a financial disaster, bankruptcy, illness, or just plain bad financial decision making in the past then the idea of swearing off credit all together and adopting a cash-and-carry lifestyle can be tempting. Deciding to close your accounts and never again apply for another credit card or loan is a drastic decision, but plenty of people have proven that it is possible to live a life free from these traditional "trappings" of the credit world. However, what followers of this cash-and-carry lifestyle fail to consider is the fact that pretending their credit doesn't matter can cost a lot of money in the long run.

Thinking that your credit will only have an impact on your life if you intend to apply for a credit card or a loan is completely unrealistic. Like it or not, we live in a very credit driven world. Here are just 7 of the negative consequences to not having good credit.

Without good credit:

- It can be hard to qualify for an apartment.

- Getting a cell phone contract can be very problematic.

- Higher insurance premiums are probably in your future.

- Getting a job or a promotion may be difficult.

- Security deposits on utility accounts are higher.

- Receiving a security clearance for a job could be very tough.

- Qualifying to purchase a home might be impossible.

The Truth About Credit "Temptation"

Again, I agree with those who believe that debt is bad. Excessive debt will waste your hard-earned money, it will lower your credit scores, it can be bad for your marriage, and it can cause you a lot of worry and stress. However, the idea that swearing off credit cards in order to avoid the temptation to go into debt is an overly simplistic approach to a complicated problem.

The root of the problem which people who are afraid of credit need to address is the fact that having credit cards is not what caused their financial and credit problems. Problems of this nature are almost always caused by poor money management habits. Saying that credit cards cause people to go into debt is like saying that spoons make people fat.

Closing your credit card accounts is not going to eliminate the temptation to over spend. In fact, for the person who has truly mastered proper money management habits, the temptation to charge more than he/she can afford to pay on a credit card is no greater than the temptation to spend too much on a debit card. Cutting up your credit cards is simply not the answer to your financial problems.

If you have made credit or money mistakes in the past, you are not alone. Don't allow the mistake of your past to define you. Instead of feeling defeated and ashamed you can challenge yourself to try again.

You should not allow let fear or misguided advice cause you to believe that a life free from the world of credit is your answer. After all, in reality there is no such thing as leading a life which is unaffected by your credit. You can embrace this knowledge or you can try to hide from it. Either way, your credit is always going to have a big impact upon your life.