For the average person attempting to negotiate with a debt collector can be perhaps one of the most intimidating and unpleasant experiences in the entire world. If you do not have a credit professional helping you and/or guiding you through the process the experience can be even worse. If you are trying to negotiate with a debt collector on your own here are 5 important tips to keep in mind before you ever pick up the phone to try to settle an outstanding debt or collection account:

Tip #1: Make Sure the Debt Is Legitimate

Collection scams are quite common. Just because someone calls you on the phone regarding a debt, even if the caller claims to work for a creditor you do in fact recognize, you should always proceed with extreme caution. First, verify that the debt actually appears on your credit reports and also ask the collection agency to send you a written validation of the debt. (The law requires them to provide this information to you when you request it.) If the debt does not appear on your credit reports and if the collector is unwilling to provide you with a debt validation then giving out any of your personal or payment information could be very risky.

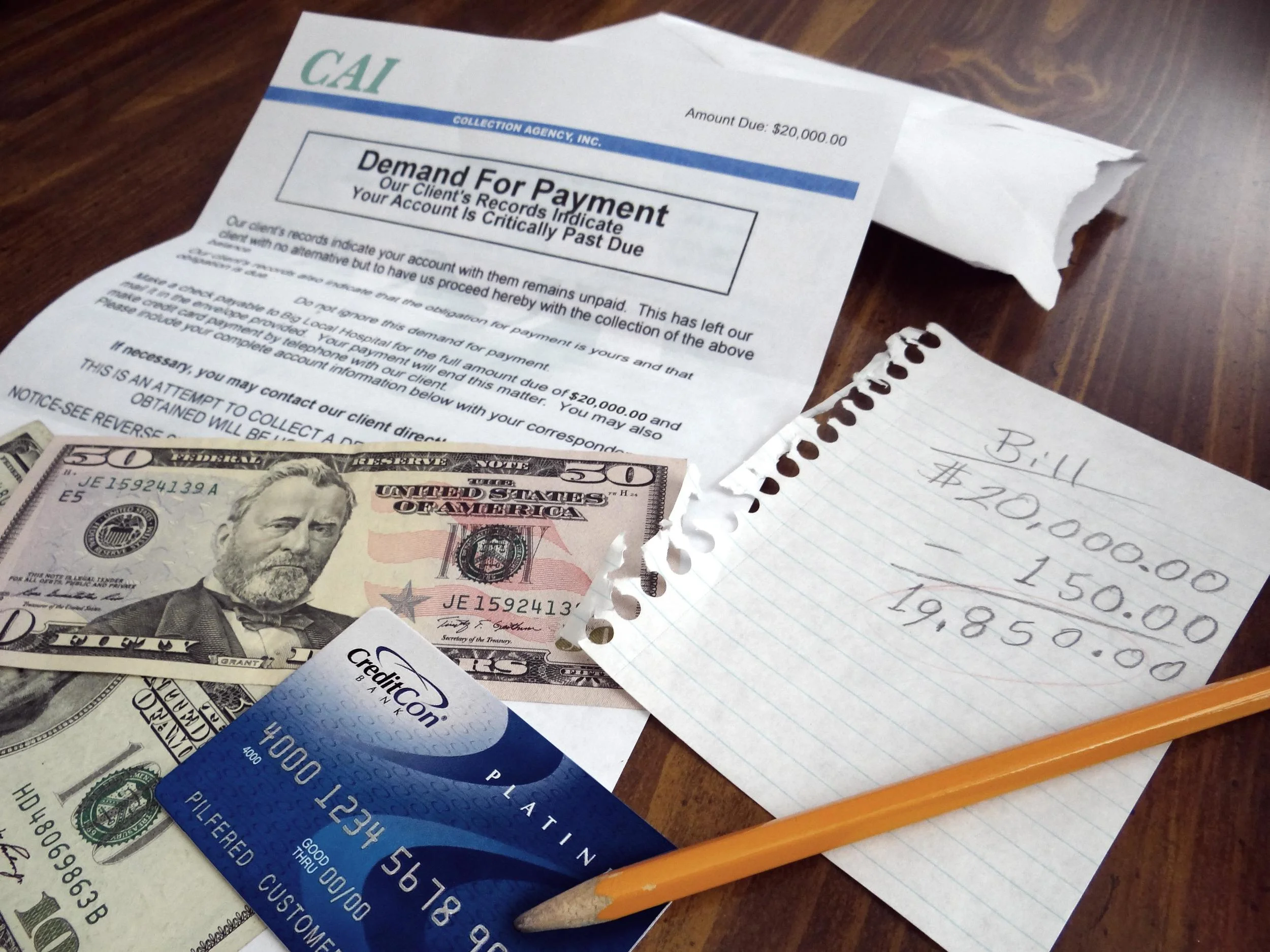

Tip #2: Paying Less Than You Owe Is Fine

When a defaulted account is purchased by a debt collector the collection agency normally only pays a fraction of the actual amount you owe to buy the debt. In fact, the collection agency probably only paid pennies on the dollar to purchase your outstanding account. If you owed your original creditor $2,000 the debt collector might have purchased the account for just $20 - $60. Therefore, if you turn around and settle the account with the debt collector for even just 30% of what was owed ($600) the collection agency actually makes a very nice profit on the settlement. Additionally, a settlement is still likely going to earn you a $0 balance on your credit reports so whether you pay the full amount or whether you negotiate to settle the debt at a lower amount you will be achieving basically the same result on your credit reports.

Tip #3: Beware of Awakening the Dead

Based upon the state where you lived when the debt was originally incurred, your debt collector will only have so long to sue you for an unpaid debt. Each state has a different statute of limitations before a debt will become time barred. Click here for a helpful chart to help you determine when your unpaid debt may have become time barred.

Once a debt is time barred you can no longer be sued by a creditor or debt collector for your unpaid debt. However, there are mistakes you can make which could possibly restart the clock on your debt's statute of limitations. For example, if you set up a payment arrangement with a debt collector instead of negotiating to pay the debt in a single, lump sum settlement then as soon as you have made your first payment you will have restarted the clock on the debt. One payment can make it fair game again for a debt collector to sue you for an outstanding debt.

Tip #4: Ask for the Deletion

Unfortunately, paying or settling a collection account is not going to automatically remove the account from your credit reports. The Fair Credit Reporting Act (FCRA) allows collection accounts to remain on your credit reports for 7 years from the date of default on the original account. Whether you pay or ignore the debt, the 7 year credit reporting clock remains the same.

One way to see an account removed from your credit reports early is to ask the collection agency to delete the account from your credit reports now, after the account has been paid or settled of course. (If you are successful, remember to get the offer in writing.) However, you should know that securing a pay-for-delete deal is likely to be very difficult if not downright impossible to negotiate.

Collection agencies actually sign agreements with the credit reporting agencies - Equifax, TransUnion, and Experian - that they will not delete collection accounts from your credit reports early simply because they have been paid. Removing a paid or settled collection account early is not illegal (that is a myth); however, it could land the collection agency in a lot of hot water with the credit reporting agencies. Scoring a pay-for-delete agreement with a creditor or debt collector is absolutely a long shot, but it certainly never hurts to ask.

Tip #5 Managing Your Expectations

As mentioned above, paying a collection account after the fact is not going to erase the item from your credit reports unless you were lucky enough to negotiate a pay-for-delete settlement. If a paid collection account remains on your credit reports then the mere fact that the balance has been updated to $0 is probably not going to have much of a positive impact (if any) upon your credit scores. In fact, sometimes paying off an old collection account can even temporarily drop your credit scores because the payment itself might be interpreted as new collection activity by the credit scoring model being used by a lender. (Crazy, right!?)

“...sometimes paying off an old collection account can even temporarily drop your credit scores because the payment itself might be interpreted as new collection activity...”

The FICO credit scoring models which are currently in use by lenders will still count collection accounts against you whether they are paid or unpaid. Therefore, a collection account with a $1,000 balance and a collection account with a $0 balance are likely to have roughly the same negative impact upon your credit scores. Paying a collection does not undo the fact that the collection occurred in the first place and the fact that the collection occurred is what is most important to many credit scoring models. As a result, you should not expect your credit scores to shoot through the roof just because you settle out an old, negative debt.

Your Next Steps

If your financial situation has improved and you can finally afford to pay your old debt then doing so may be a good idea. After all if you owe a legitimate debt then the right thing to do is probably to honor your financial commitment if possible. However, you may wish to consult with a credit expert first to be sure that you protect yourself from making any mistakes which might either hurt your credit or expose

Michelle Black is an author and leading credit expert with nearly a decade and a half of experience, a recognized credit expert on talk shows and podcasts nationwide, and a regularly featured speaker at seminars across the country. She is an expert on improving credit scores, budgeting, and identity theft. You can connect with Michelle on the HOPE4USA Facebook page by clicking here.