Let's face it, no one plans on having bad credit. Aside from a few bad apples, the vast majority of consumers never set out with the intention of acquiring debt and failing to pay it off according to terms. Instead, most consumers who develop bad credit do so as a result of some unfortunate circumstance such as a job loss, an illness, divorce, etc. Even those consumers who find themselves swimming in collection accounts as a result of poor financial planning typically do not realize that they have overextended themselves financially until they have already bitten off more than they can chew.

One of my favorite sayings is the HOPE4USA slogan, "Bad credit happens to good people all the time." The reason why this statement means so much to me is because it is 100% true. Whether a person is facing credit problems due to bad luck or bad decisions, that does not mean that he or she is a bad person. Everyone deserves a second chance.

Cleaning Up Past Mistakes

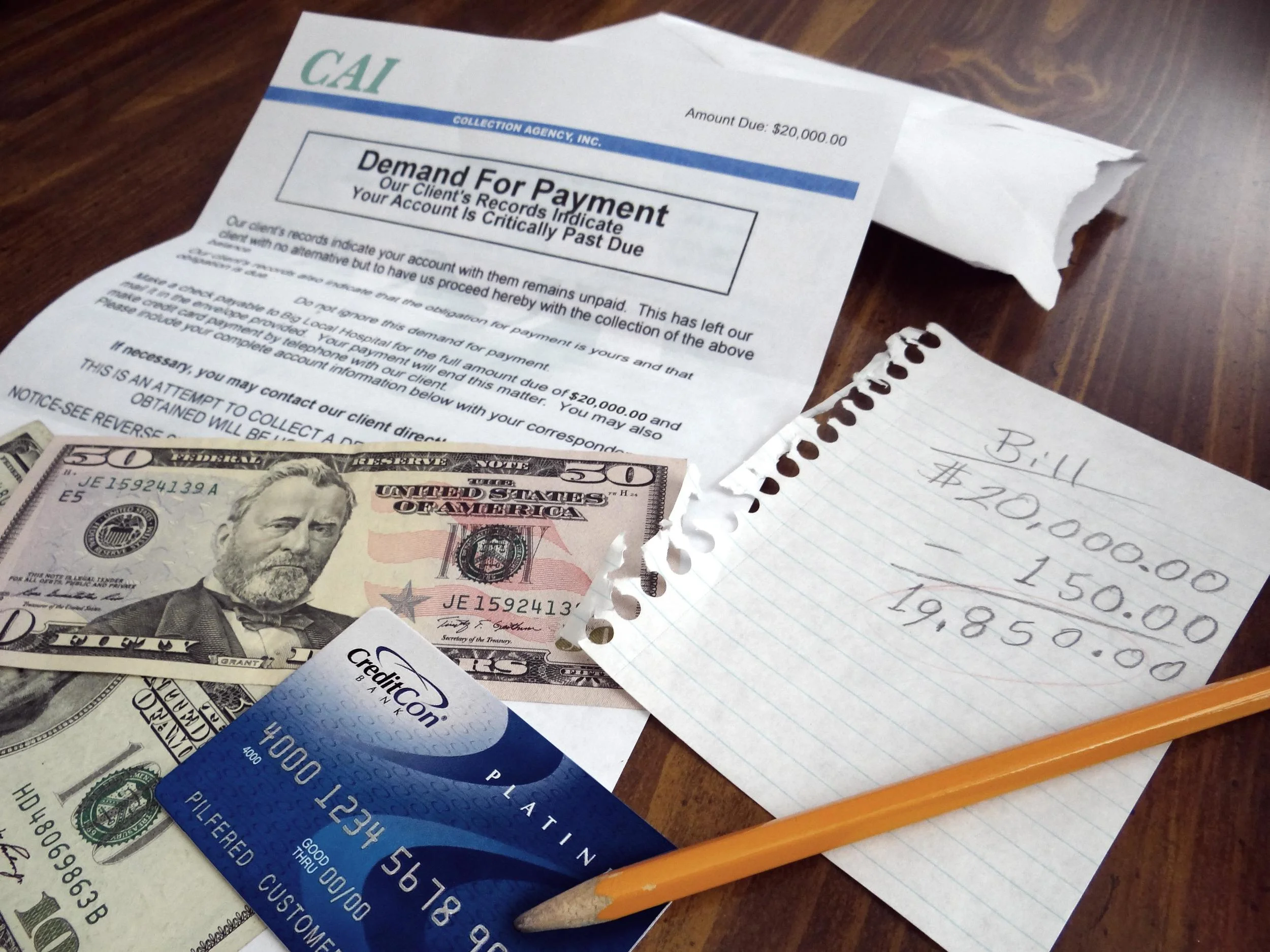

Unfortunately, when most consumers set out to begin cleaning up their past credit mistakes they do it wrong. I cannot count how many consumers have expressed their frustration to me over the years after they paid off a pile of old collection accounts and their credit scores remained low - often even lower than they were initially. The fact that most consumers fail to understand is that paying off or settling collection accounts generally will not do anything to improve credit scores.

Why Paying Collections Doesn't Raise Credit Scores

The FICO credit scoring models currently in use by lenders do not reward consumers for paying off collection accounts. Current versions of FICO are much more concerned with the fact that a collection occurred in the first place than they are with the balance of the account. In fact, a collection account will have virtually the same negative impact upon a consumer's credit scores whether the balance is $2,000 or $0. (Defaulted credit card accounts are typically the exception to this rule.)

The purpose of a FICO credit score, also known as the design objective, is to predict the likelihood that a consumer will become 90 days past due on any of his/her credit obligations within the next 2 years. Current FICO credit scoring models are built with the assumption that a consumer who had collection accounts in the past is still likely to be 90 days late on an account in the future. Therefore, the presence of a collection account - regardless of the balance - is going to have a negative credit score impact.

Change on the Horizon?

FICO 9, the most recent credit scoring model released by FICO was designed to treat $0 balance collection accounts very differently than they have been treated in the past. The new scoring model was built with scoring logic to completely ignore collections with $0 balances. The result? Consumers who settle or pay their collection accounts could potentially see a massive score increase under the new scoring model.

Before you get too excited it is important to realize that it will likely be many years before FICO 9 is widely adopted by lenders - if it is even adopted at all. Check out my previous article, "Why You Shouldn't Be Too Excited About the New FICO 9 Scoring System...Yet" for more details. If lenders are not using the new scoring model then it is impossible for consumers to see any benefit from the new scoring logic.

What Should I Do?

If you believe that the fact that settling your collection accounts will not likely help your credit scores is a good reason to ignore the accounts, you may want to think again. Unpaid collection accounts have the potential to come with a lot of nasty consequences. Lawsuits, judgments, and wage garnishments are a few of the unpleasant side effects that often accompany unpaid debts. Settling past due accounts can be a very smart move, though it may be advisable to consult with a reputable professional for help and guidance before you get started

Where to Begin

It is important not to become overwhelmed when you make the decision to begin trying to fix past credit issues. The best place to start is to get a copy of all 3 of your credit reports (and possibly your scores as well). You can access a free credit report from each of the 3 major credit bureaus every year at www.annualcreditreport.com. Credit scores are not free, but you can often access them as part of a free or inexpensive trial to a credit monitoring service. CLICK HERE to compare trial offers which offer 3-credit scores.

Once you have your reports, review them thoroughly for mistakes. Credit mistakes happen more commonly than many consumers realize. In fact, the FTC estimates that over 40 million consumers may have errors on their credit reports.

When reviewing accounts for errors remember that all aspects of the account (i.e. balance, date opened, date of last activity, etc.) should be correct. If errors are discovered you have the right according to the Fair Credit Reporting Act to dispute those errors. You can dispute credit errors on your own or with the help of a professional. CLICK HERE for a great, free Credit Repair Toolkit to help you get started or you can schedule a no-obligation credit analysis with a HOPE4USA Credit Expert.

Michelle Black is an author and a credit expert with over a decade of experience, the credit blogger at HOPE4USA.com, a recognized credit expert on talk shows and podcasts nationwide, a contributor to the Wealth Section of Fort Mill Magazine, and a regularly featured speaker at seminars up and down the East Coast. She is an expert on improving credit scores, credit reporting, correcting credit errors, budgeting, and recovering from identity theft. You can connect with Michelle on the HOPE Facebook page by clicking here.